By: Darren W. King | Wealth Management

Source: Bloomberg, Inc.

Key Takeaways:

- Fed slashes fed funds guidance to 2 cuts for 2025 from the anticipated four 25 basis point cuts

- Fed lowers interest rates by 25 basis points in December. Fed funds at 4.25%-4.5% today and forecasted to be 4.0% by year-end 2025 with the terminal rate now higher to 3% longer term.

- 2024 GDP estimates revised higher to 2.8% from 2% earlier in the year

- The headline Consumer Price Index ends 4Q2024 at 2.7%, down from 3.8% in the 1Q2024

- Unemployment finishes November at 4.2%, down from 4.3% in July

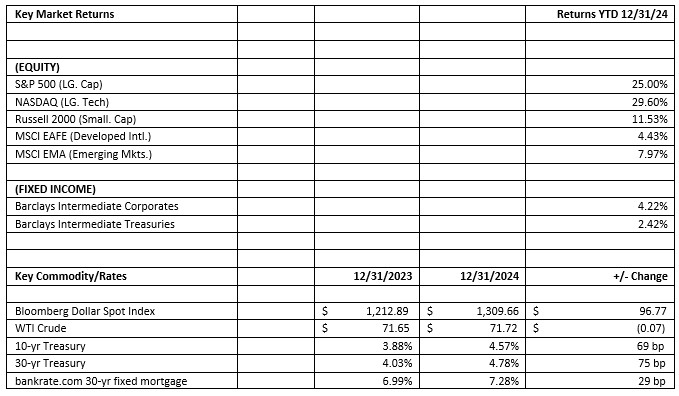

- S&P 500 up 25% in 2024 and 2nd year of gains greater than 20%

Equity Strategy

We are expecting a more normalized return environment for equities in 2025 with valuations needing to also normalize after the strong rally over the past 2 years. Equity markets have come off recent highs as investors are zeroing in on interest rates moving higher on new expectations for stronger growth policies with the Trump administration. The growth scares of the summer months have subsided as inflation and rates become a bigger focus. While we are prepared for some equity weakness in the first half of 2025, we see earnings providing support for equity returns over the course of the year. A strong 4th quarter earnings season and positive forward guidance for 2025 could very well flip the narrative that stronger growth is a negative, despite higher interest rates.

Fixed Income Strategy

Within the fixed income markets, interest rate, fed policy, and market traders see two more twenty-five basis point interest rate cuts in 2025, following stronger consumer spending and GDP growth going into 2025. This was a surprise to the market that was anticipating four 25 basis point fed cuts in 2025. Ten-year treasury rates are currently at 4.68% as of January 8, up eleven basis points from the end of the year, and up 93 basis points from the end of the third quarter. The corporate bond market is now offering yields greater than 5% for maturities greater than 5 years. We see current interest rate levels as an opportune period to extend portfolio duration, invest excess cash in fixed income markets, or take some profits from equity portfolios to add to fixed income exposure.

Click here to read the entire Q4 2024 Market Review.

Non-Deposit Investment Services are not insured by FDIC or any government agency and are not bank guaranteed. They are not deposits and may lose value.