By: Darren W. King | Wealth Management

Source: Bloomberg, Inc.

Key Takeaways:

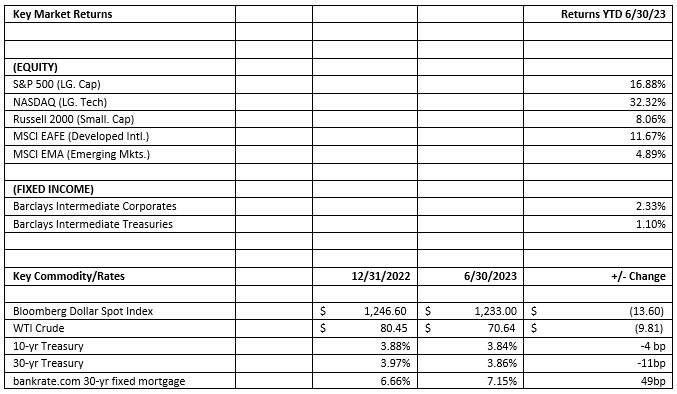

- Inflation peaks in 4th quarter 2022, fed interest rate policy pauses in June with 1 to 2 more hikes now expected in the second half of 2023

- US stock and bond markets both post positive returns in the first half of 2023

- 90% of the first quarter S&P 500 return attributed to AI stock craze and 40% tech sector rally

- Currently at 5.25%, fixed income markets now see a 5.65% fed funds rate by year-end 2023

- The Consumer Price Index posts 4% inflation in June with services inflation still elevated

- Labor market remains hot despite tightening cycle. Unemployment at 3.6%, lowest level since 1969 with wage growth higher than current inflation numbers

Equity Strategy

Based on current consensus earnings forecasts, the forward 12-month P/E ratio for the S&P 500 is 18.9X, more expensive than the ten-year average P/E of about 17.4X. Much of the recent rally in the equity markets has been liquidity driven. Investors have put high cash levels back to work as the economy and corporate earnings have remained more resilient than worst case fears as a recession expected in the first half of 2023 has not yet materialized. For now, equity markets feel that the severity of any future recession has lessened over the course of this year.

Fixed Income Strategy

While interest rates fell during the first quarter of the year and the bond market was pricing for recession and interest rates cuts in 2023; most of the bond market rally has retreated and investors are now seeing a much tougher road to moving inflation back down to the fed’s 2% target. Following these developments, the 2-year treasury started 2023 at 4.43% and has risen to 4.99% today (July 13). The 10-year treasury has risen from 3.88% at year end to 4.04% today, while the 30 year treasury has risen from 3.97% to 4.00% today. The Moody’s Seasoned Aaa Corporate Bond yield, currently at 4.69%, is at the highest levels seen in a decade, but has fallen from recent highs in November of 2022 at 5.09%. In our opinion, the fixed income markets still offer yields that provide an alternative to equity only investing that has not presented itself in the last decade’s low interest rate environment and would provide a hedge to any severe equity market correction and recession selloff.

Click here to read the entire Q2 2023 Market Review.

Non-Deposit Investment Services are not insured by FDIC or any government agency and are not bank guaranteed. They are not deposits and may lose value.